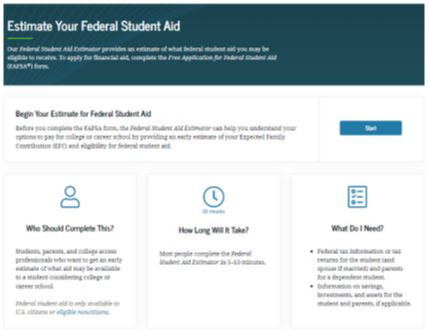

Please visit www.fafsa.gov to access the FAFSA form to complete for Federal Financial Aid.

FAFSA4caster is a free online tool available to provide students and parents with an estimate of an Expected Family Contribution. (This is not an official application and does not require an electronic PIN but can give families awareness and education about the financial aid process.)

Financial Literacy Tools

FINANCIAL AID TIMELINE: Know what to do when

For ANYONE who wants to learn more about finding an affordable higher education, follow financial aid experts Linda Pacewicz and Dan Wray of Pennsylvania Higher Education Assistance Agency (PHEAA) as they guide you along the exciting (and sometimes bumpy) road to an affordable higher education. The journey will begin before high school and end in the land of education loan repayment – or maybe even education loan forgiveness. One thing is for certain: it’s never too early to start preparing for a successful higher education experience. This 1-hour presentation will provide the starting points and web resources – for effective research before, during, and after your student makes postsecondary decisions. Know what to expect and to plan for it is the key. Failing to plan is, planning to fail!

Register for PHEAA webinars here

Find more PHEAAA webinars at this website https://www.pheaa.org/virtual/index.shtml

FAFSA®

Filing the FAFSA® (Free Application for Federal Student Aid) adds up to $$ for college. If you do not submit a FAFSA, you could miss out on free money and low-cost loans for school. Filling out the application is easier than you think. And it's free! Complete the FAFSA as soon as you can after October 1, although individual financial aid deadlines can vary by school, state, program of study, and more.

You must complete the FAFSA to qualify for:

Federal aid programs—Pell grants, Perkins loans, Stafford Loans, work-study employment

Pennsylvania state aid programs—the Pennsylvania State Grant Program, work-study employment

School aid programs—private grants, need-based scholarships

Deadlines

Documents

Have the following documents available when completing the FAFSA:

Social Security Numbers

Driver's license (student only; this information is optional)

Federal income tax return (1040, 1040A or 1040 EZ)

W-2 forms from all employers

Current bank statements (Checking and Savings)

Current Business and farm records (if applicable)

Records of any stocks, bonds, and other investments, including 529 accounts

Additional untaxed income tax records may be needed such as: Veteran's non-educational benefits, child support paid/received and workers compensation

Alien registration or permanent resident card (if not US Citizen)

PIN Numbers

Personal Identification Number (PIN) used to sign the FAFSA, make corrections (if necessary), and check the status of the online FAFSA application.

Both the parent and the student must have a PIN number. Students can electronically sign his/her Master Promissory Note for student loans. Parents can use his/her PIN number to electronically sign the Direct PLUS Loan MPN. Parents can use the same PIN for multiple dependent children attending a postsecondary school.

Go to Create FSA Pin to choose a PIN.

PA State Grant Form

To be considered for a PA State Grant, students must complete the FAFSA and the State Grant Form (SGF). There are three ways to complete the SGF:

A link on the FAFSA Application Confirmation Page: You must click on the link from the completion page, you can not return to this page once exited.

A link in an email from State Grant or using the link on PHEAA.org

Paper status notice

Student Aid Report (SAR)

A Student Aid Report will be sent to the applicant via email once the FAFSA is processed. The information found on the SAR is also sent to all schools students have listed on his/her FAFSA and to PHEAA.

Expected Family Contribution (EFC):

A calculated amount a family can be expected to pay towards a student's college expense each year.

Factors determining the EFC: Parental income and assets, student income and assets, family size and number of family members in college, and age of the older parent

This number is the same, regardless of what school the students chooses to attend.

CSS Financial Aid Profile

http://student.collegeboard.org/css-financial-aid-profile

Should be completed in addition to the FAFSA but ONLY if the school attending accepts the CSS Application.

There is a $25 fee for completing this application

Available October 1.

The following schools accept the CSS application:

Abrahan L Buckwalter Fund

Albright College

Bryn Mawr College

Bucknell University

Carnegie Mellon University

Dickinson College

Drexwl University

Eastern Baptist Theological Seminary

Franklin & Marshall College

Gettysburg College

Haverford College

Hughesian Free School Trust

Lafayette College

Lehigh University

Lower Merion Twp Scholarship Fund

Moravian College

Muhlenberg College

Rosemont College

Seneca Valley School District

Susquehanna University

Swarthmore College

University of Pennsylvania

Ursinus College

Villanova University

Helpful Websites

www.mysmartborrowing.org : an interactive financial aid tool that encourages students to make smart decisions about career and college choices

www.financialaidtoolkit.ed.gov

www.educationplanner.org : in-depth resources helping students learn about careers, colleges and financial aid opportunities

www.youcandealwithit.com : offers college students and recent graduates a comprehensive guide to financial decisions and situations they will soon encounter.

*Information provided through PHEAA and PA Association of Student Financial Aid Administrators